Accounting questions and answers. 85 Use of the FIFO cost flow assumption means that.

What Are Cost Flow Assumptions Accounting Services

FIFO will help company gain more profit.

. In manufacturing as items progress to later development stages and as finished inventory items are sold the associated costs with that product must be recognized as an expense. FIFO stands for First-in First-out cost flow assumption which means the first oldest purchase prices are the ones we assign to COGS. The beginning inventory contains the oldest costs Oe.

If specific identification is used there is no need to make an assumption FIFO LIFO average are assumptions because the flow of costs out of. Up to 24 cash back Use of the fifo cost flow assumption means that Average cost flow assumption is a calculation companies use to assign costs to inventory goods cost of goods sold COGS and ending inventory. Inventory Cost Flow Assumption Definition ____ The underlying concept of FIFO is that the earliest inventory purchased would be sold first.

See first in first out FIFO. D the ending inventory contains the most recent costs. FIFO stands for First-In First-Out.

D The beginning inventory contains the oldest costs. Under the last in first out method you assume that the last item purchased. In most companies this assumption closely matches the actual flow of goods and so is considered the most theoretically correct inventory valuation method.

All of these are correct answers. LIFO and a higher inventory valuation. A cost flow assumption where the first oldest costs are assumed to flow out first.

The FIFO method is used for cost flow assumption purposes. Therefore the choice of FIFO accounting results in lower COGS on the income statement vs. LIFO cost flow assumption.

View the full answer. The costs paid for those oldest products are the ones used in the calculation. O a Goods are removed from inventory at their average cost O b.

A Goods are removed from inventory at their average cost. An average is taken of all of the goods sold from inventory over the accounting period and that average cost is assigned to the goods. This method is used when a cost flow assumption has to be made.

The average cost flow assumption is one of a variety of cost flow assumption methods used to determine the. First In First Out FIFO Cost Flow Assumption Method Using this cost flow assumption means you assume that you will sell the oldest products in. The first in first out FIFO method of inventory valuation is a cost flow assumption that the first goods purchased are also the first goods sold.

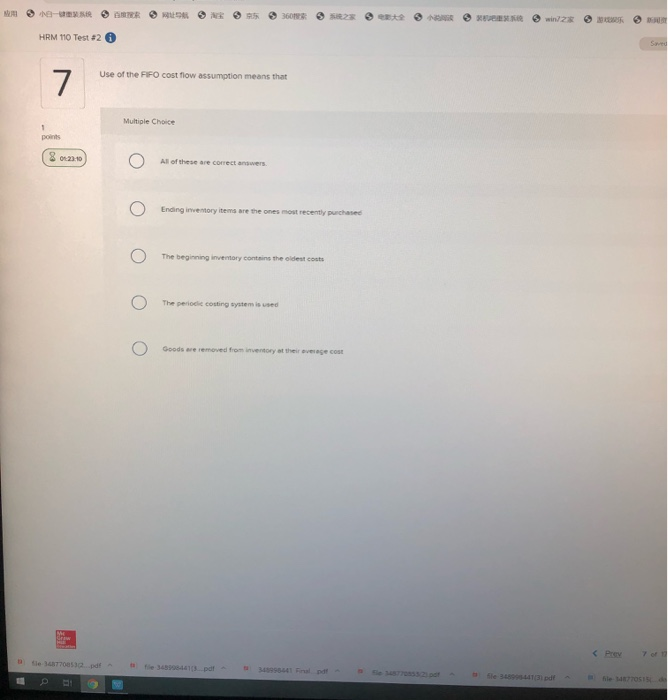

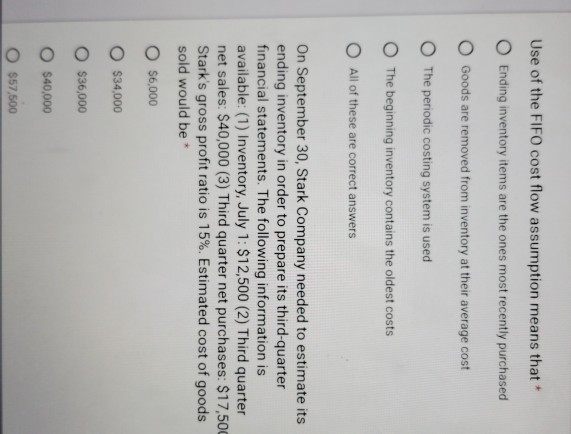

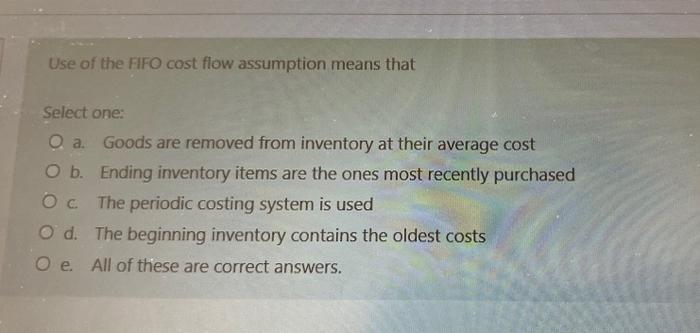

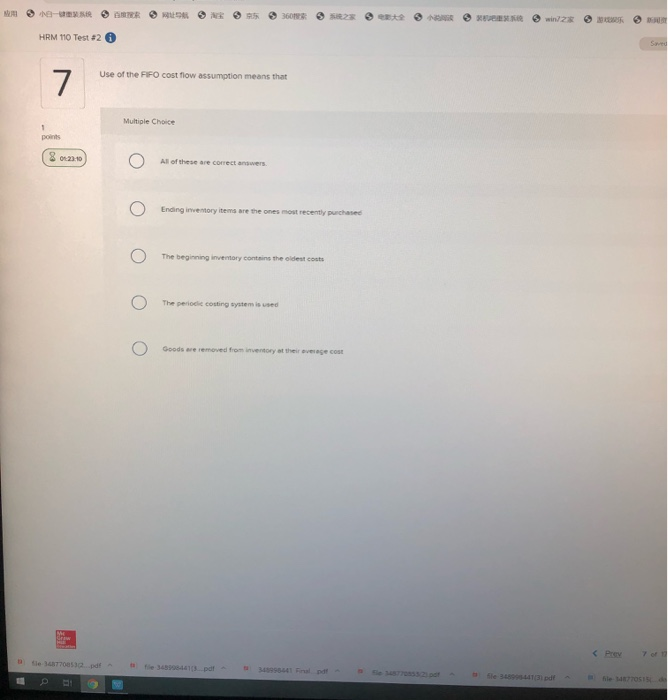

Use of the FIFO cost flow assumption means that Select one. Use of the FIFO cost flow assumption means that O Ending inventory items are the ones most recently purchased O Goods are removed from inventory at their average cost O The periodic costing system is used O The beginning inventory contains the oldest costs O All of these are correct answers On September 30 Stark Company. Since this is the lowest-cost item in the example profits would be highest under FIFO.

The FIFO method assumes that the oldest products in a companys inventory have been sold first. Ending inventory items are the ones most recently purchased Oc The periodic costing system is used Od. To learn more see Explanation of Inventory and Cost of Goods Sold.

Use of the FIFO cost flow assumption means that O a b Ос The beginning inventory contains the oldest costs Goods are removed from inventory at their average cost Ending inventory items are the ones most recently purchased The periodic costing system is used Od. Barnes Noble for example reports that its gross margin was 309 percent in 2008 and 304 percent in 2007. It is a method used for cost flow assumption purposes in the cost of goods sold calculation.

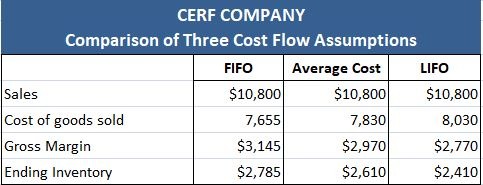

Why does LIFO usually produce a lower gross profit than FIFO. -Companies using FIFO will report the highest gross profit and net income-Weighted average cost of goods sold will be between FIFO and LIFO costs of goods sold-Companies using FIFO will pay higher taxes than companies using LIFO assuming all else being equal-Companies using FIFO will report the smallest cost of goods sold. The stock clerk loads milk from inside the refrigeration unit putting the newest milk in behind the older.

Order custom essay Inventory Cost Flow Assumptions with free plagiarism report. C Ending inventory items are the ones most recently purchased. When working with FIFO the cost of the inventory bought first will be identified first.

FIFO cost flow assumption. The fifo cost flow assumption assumes. It means the inventory that you sell costs you less than the inventory that you have remaining.

Average Cost Flow Assumption. Use of the FIFO cost flow assumption means that. See à â Å What is an example of FIFO and LIFO below.

First in first out FIFO definition. What inventory method does Tesla use. The term cost flow assumptions refers to the manner in which costs are removed from a companys inventory and are reported as the cost of goods sold.

This means the latest recent costs remain on hand. Considering manufacturing as goods move towards the last stages of development and as stock in the inventory gets sold the cost related to the product must be identified as an expenditure. A calculation used by companies to monitor inventory goods.

Use of the fifo cost flow assumption means that. Why do companies use cost flow assumptions to cost their inventories. B the ending inventory contains the oldest costs.

FIFO cost flow assumption definition. B The periodic costing system is used. The cost flow assumptions include FIFO LIFO and average.

E All of these are correct answers. It is the amount by which the income subject to taxes from a company using the LIFO method has been deferred. Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials Read all 2237 Testimonials.

A familiar physical cost flow example of this assumption would be milk. C the periodic costing system is used. Thus the cost of goods sold would be 50.

Under the first in first out method you assume that the first item purchased is also the first one sold. The FIFO method is used for cost flow assumption purposes. The fifo cost flow assumption assumes that the cost of items purchased.

The FIFO flow concept is a logical one for a business to follow. A the perpetual costing system is used. Cost flow assumption examples.

In manufacturing as items progress to later development stages and as finished inventory items are sold the associated costs with that. In other words the current inventory is assigned the most recent costs.

Solved Use Of The Fifo Cost Flow Assumption Means That O Chegg Com

Solved Use Of The Fifo Cost Flow Assumption Means That Chegg Com

Solved Amrr Leon R 2 Te We Hrm 110 Test 2 Win7z K Us 7 Chegg Com

0 Comments